Just like Boom, Crash and other Volatility indices, the Jump Index can give you fast profit in a matter of minutes. The Jump indices which is currently only on the Deriv platform includes: Jump 10 index, Jump 25 index, Jump 50 index, Jump 75 index and Jump 100 index.

Don’t be left out, Learn how to trade forex the right way, Click here to get started

I have studied and traded the Jump Indices for the past one month and I am very excited to tell you that Jump 10, 25, 50, 75 and 100 obeys price action.

Table of Contents

This is how To trade the Jump Index successfully

1. Understand price action

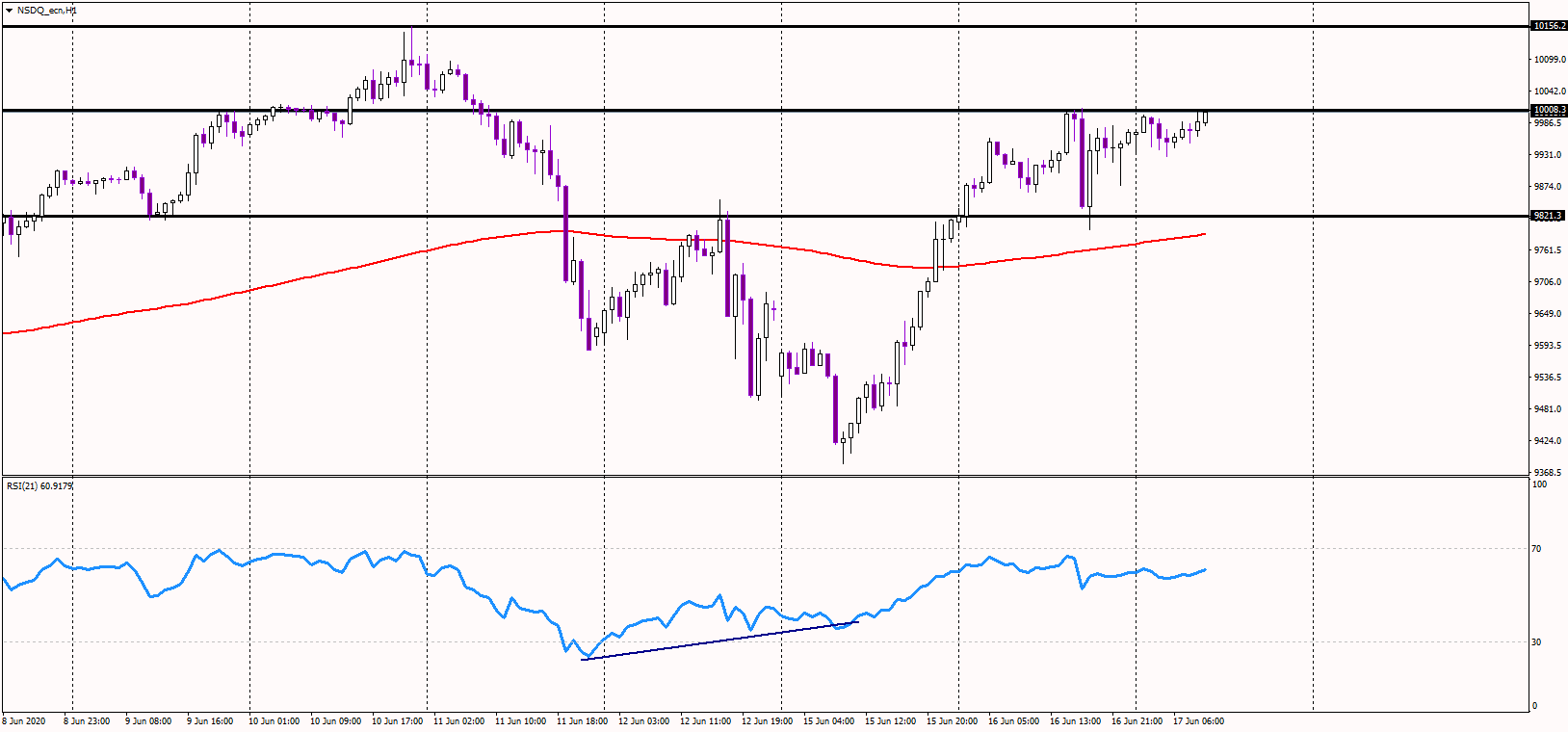

If you want to be successful in trading the Jump indices, you must understand price action. In almost all my articles on forex, I have emphases the important of price action. As a rule of thump, If you don’t understand price action, you don’t have any business in trading.

Generally, price action describes the characteristics of the movement of any indices in the market, which means before any indices moves in any direction, there is a pattern or structure that supports that movement. I always advice new traders to spend some time to study and understand price action, because when they do, analyzing the market becomes simpler.

2. Trade only patterns and trends

Successful traders don’t place trade based on what they think, but based on what the market is telling them, once they spot a pattern in the market based on price action, they invest on it and wait patiently with a conservative lot for the profit to start rolling. So in trading the Jump indices, don’t be in a hurry to close a trade in red except there is a market pattern violation.

3. Use Conservative lot size

It always good to trade indices like the jump indices, volatility 75 with a conservative lot size, you can only use aggressive lot size when there is a trending market or you have good equity.

4. Always remember to lock your profit

As a conservative trader, I believe in the concept of compounding profit. My own idea of compounding profit is trying to grow your balance even while you have some trades running. Many people have suggested, opening two or three positions depending on your equity, then closing some by reducing the lot size to increase your profit and re-entering again if the price action dance back to your previous entry point. This way your trading balance increases so that even if make a little miscalculation you will still end the day in blues.

5. Work on your emotions

In my first week of trading, I closed few trades out of emotions and after some minutes I realized that the trade had gotten to my TP according to my analysis. Defeating this emotion was not easy, but I was determine to win in the market so I worked on my emotion and my trade results was amazing.

After analyzing your trade, place a TP and Stop loss, only close your market in red if the market pattern or structure is violated

6. Look for a trading buddy.

Trading is meant to be fun. Don’t struggle along, seek guidance from an established traders or join the community of upcoming trader to share ideas and grow your network.

Do you have any questions? Drop a comment below

Disclaimer

Deriv offers complex derivatives, such as options and contracts for difference (“CFDs”). These products may not be suitable for all clients, and trading them puts you at risk. Please make sure that you understand the following risks before trading Deriv products: a) you may lose some or all of the money you invest in the trade, b) if your trade involves currency conversion, exchange rates will affect your profit and loss. You should never trade with borrowed money or with money that you cannot afford to lose.

Hello brother, What time frame do you use to analyze the Jump Indices and what time frame do you use for your entry?

5 min is best

Use all the time frames to analyse and see the direction where the market is going. For entry use 1 min and 5 min time frame

Can I join your trading society?

Does the spikes shift the SL and TP

I want join your trading society

i would like to join your trading group

Hello, good day. I recently started trading and I got into jump, majorly jump index 100 and I got spanked really hard… almost fainted but I am still standing. Please in will like to join your platform on telegram if you have any. Thanks