The advent of decentralized finance (defi) was a result of tackling the shortcomings of traditional finance. Such as central control of the government, limited financial freedom, etc., The first cryptocurrency, Bitcoin was launched in 2009 to minimize the control of third parties such as financial institutions like banks; political influence by the government of a country and the common manipulations of fiat. To achieve this, Bitcoin relied on a concept known as cryptography which aids a peer-to-peer transaction system that eliminates middlemen typical of a traditional financial system. This article explains cryptocurrency in the light of the greater fool’s theory

There are over 15,000 cryptocurrencies at press time. This has attracted the attention of certain government agencies such as the Securities Exchange Commission (SEC). Even though the crypto space was created for freedom purposes, such as freedom from such governmental bodies like the SEC, the freedom and spirit of decentralization of the space have been exploited by certain persons mostly anonymous, disguising under the pretense of upholding decentralization.

Scam coins and shit=coins have flooded the industry. Complaints from investors who have fallen prey to scam crypto projects have necessitated the urgency of the SEC to promulgate regulations for the crypto space. Their argument is that they need to protect investors’ interests even though some are of the view that the argument is vague. There is no doubt that the crypto space has become a breathing ground for financial manipulations where those with huge capital, called whales, take advantage of investors with little capital. This is what informed the decision to write about understanding cryptocurrencies in the light of the greater fool’s theory.

Table of Contents

What is the Greater Fool’s Theory?

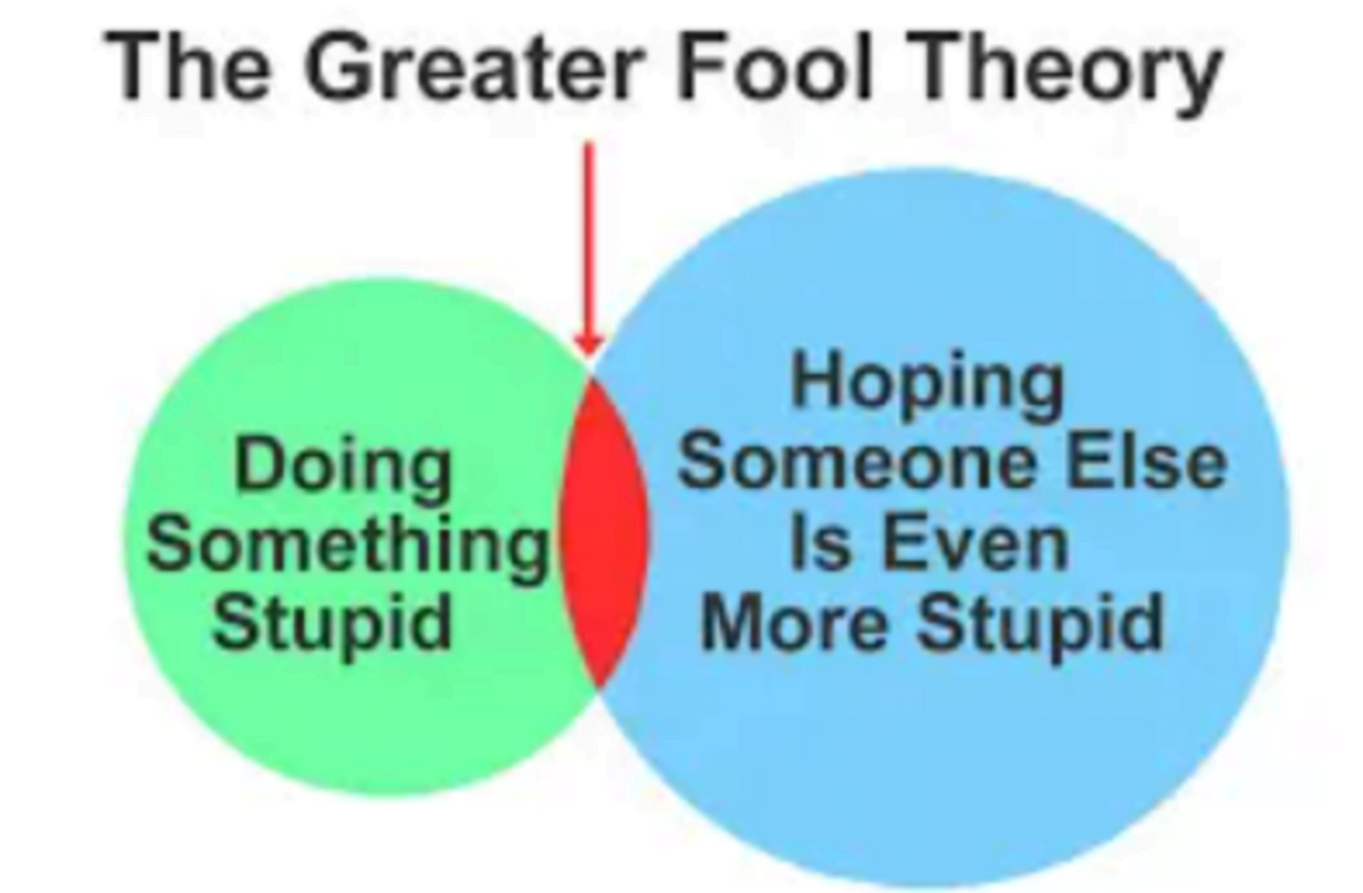

The Greater Fool’s theory is a simple term that explains the demand and supply operations of risk assets such as stocks and cryptocurrencies. To make it very simple, the term Greater Fool’s theory in the context of this article explains the activity of investors purchasing cryptocurrencies at exorbitant prices with the believe that they will sell it at even more higher prices to other investors willing to buy. For example, buying 1 Bitcoin at $20,000 in a bear market and hoping to sell at $69,000 during a bull run is a classic example of the greater fool’s theory.

Governments that were initially against decentralized finance have now gotten involved and have labelled Bitcoin as a commodity and many other crypto assets as securities. To be sincere, the technology this new financial system operates on is so amazing that those who have fought it have now joined and are looking for ways to benefit from it.

It will interest you to know that even the US Federal Reserves are interested in decentralized finance and are working on ways to tokenize the US dollar in such a way that it will become a digital currency.

China on the other hand plans to . .

China is popularly known to have banned cryptocurrencies in the past, but they are planning to launch a digital Yuan

Some government of certain countries are even looking to make Bitcoin their country’s official currency. El-Salvador made Bitcoin its legal tender in September, 2021, becoming the first country to allow consumers to use the cryptocurrency in all transactions, alongside the US dollar.

Despite the attractive benefits of Bitcoin, such as having a limited supply of 21 million coins which beats fiat to its game, the crypto space is being manipulated on a daily basis.

Manipulation of the Crypto Space

Bitcoin serves as a reference for the creation of other cryptocurrencies. While some creators were inspired by Bitcoin’s art, others took advantage of the free space that had no regulations from a government body to perpetuate Ponzi schemes and cart away with millions of dollars. This is why the crypto noob is always advised to do a research before investing in any form of cryptocurrencies. There are oodles of crypto projects with weak fundamental base and have been propped to fail. An in-depth research will save the unsuspecting investor from falling prey to such projects.

Crypto Never Sleeps

The cryptocurrency space never sleeps unlike the stock market that closes on weekends. This has given the greater fool’s theory a free day where investors with large funds buy up as much cryptocurrency as possible which drives the price high and attract investors who don’t want to miss out, in the process, these investors who invest based on fear of missing out (FOMO) often have little capital and most of the time, end up with burnt fingers when those with huge capital take their profit. Those with huge capital are known as whales who manipulate the crypto market.

Rumors have it that the Fed has become the biggest whale using the powers at their disposal to influence the economy of risk assets such as stocks and crypto. Information provided by a fact checker confirms that 9 trillion dollars have been printed since 2020 during the COVID-19 pandemic. This has critically affected the global economy causing inflation. And as a result of controlling inflation, the same Fed has started hiking interest rates which in turn has made prices of risk assets such as cryptocurrencies collapse and in turn reduced purchasing power of fiat.

Since the Fed can print money at will, same money can be used to purchase cryptocurrencies such as bitcoins which will drive the price up, attract unsuspecting investors who will later bear the brunt when they dump. A classic epitome of the greater fool’s theory.

But despite the manipulations of the space, Bitcoin is still better than fiat.

Why Bitcoin is Better than Fiat

Although, it can be manipulated, but the life span of the manipulation is numbered due to the limited supply. Unlike fiat (any country’s currency) which has no limited supply and can be printed at will.

Digital Gold

Gold is a classic example of a commodity with a limited supply because it is natural and can’t be manufactured. All the gold that will ever exist are fixed. No wonder why most people regard bitcoin as digital gold. The limited supply will always drive its value up. Irrespective of market conditions, and manipulations, no matter how low the price of Bitcoin goes, it will always go back up. Just recently, the US SEC has claimed to categorize bitcoin and some other cryptocurrencies under commodity assets

The Bottom Line

The greater fool’s theory explains the operations of cryptocurrency where one investor buys a coin or token and waits for the price to go higher, then sell to another investor willing to buy at a higher price. And the cycle continues when the greater fool who purchased at a high price waits to sell even at a higher price to another greater fool. Thus, the greater fool’s theory.

Let me clap for myself by myself. You know that feeling when you impress yourself? Yeah, I love this article and I am impressed by myself. Lol.