Understanding the best timeframe for trading Crash 500, Boom 500, Volatility 75, Step Indices, and other synthetic indices is one of the things that will help you to be successful in trading.

It’s true, you can trade Forex with any timeframe of your choice based on your trading skills and strategy, but your success will greatly depend on how you can easily utilized each timeframe to your trading advantage.

The Best Timeframe for trading Boom and Crash Markets

Just like in every financial market, profitable trading come with its own set of rules which must be obeyed. Even so, in trading Synthetic indices, flexible adherence to these rules makes trading enjoyable and easy.

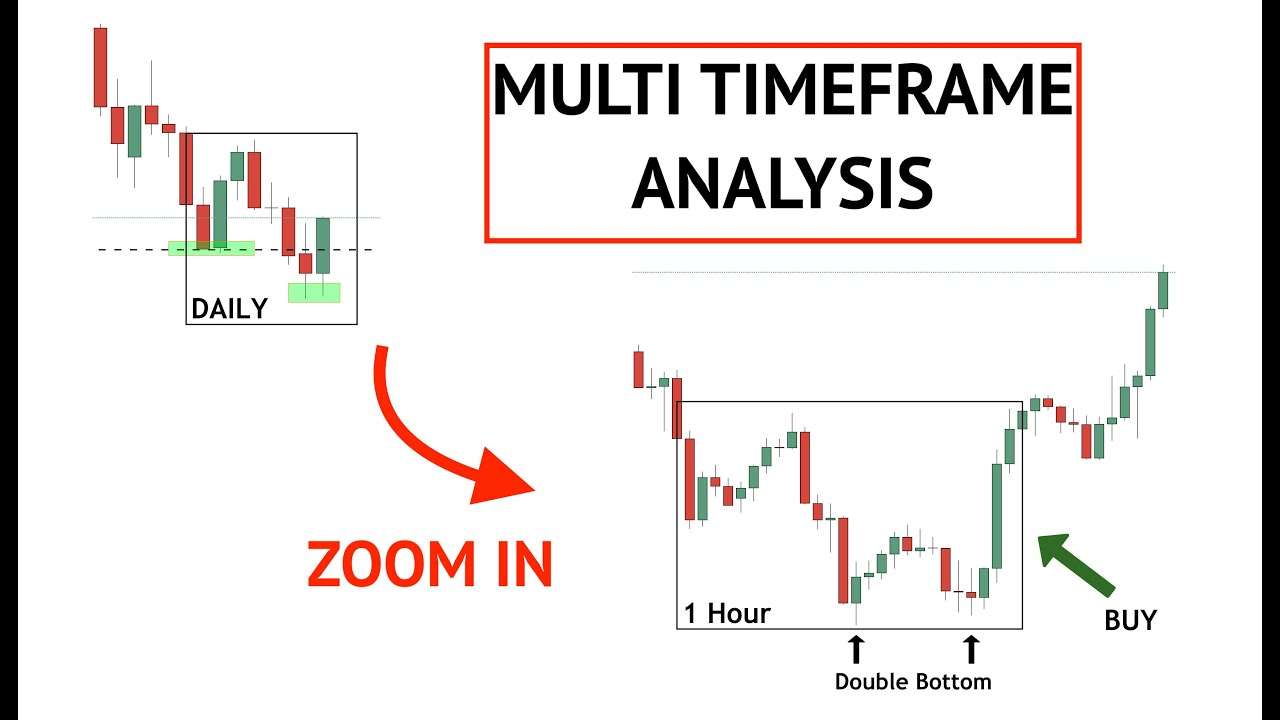

Timeframe combinations is one of the most important trading skills a trader needs to have at his fingertips. Often times, it is one of the most confusing, if not the most confusing concept to understand its dynamics. Due to this confusion, taking good trading decisions seems difficult, if not nearly impossible. At extreme measures, the confusion may extend to where trading becomes almost a fearful and an impossible adventure to dare. To clear the fog covering the mind of traders, one must have a good knowledge of timeframe combinations. Because, timeframes are not a ‘standalone’ component of financial market trading rather, are an integrated components that works better when it is understood.

Timeframes are specific periods in which price movement are segmented into to help traders of different personalities know where and when to make analysis, take or exit trading positions. Timeframes are segmented! And it has relative interpretation. Timeframes are segmented into higher timeframes and lower timeframe. Higher timeframes such as Monthly, Weekly, Daily and Hourly (H8 and H4) is often used for analysis while lower timeframes such as Hourly (H1), M30, M15, M5 and M1 are used for entries and exits.

The relative interpretation of timeframes boils down to knowing that; depending on the kind of trader a person is, what appears like a higher time frame may seem to be a lower time frame for another. For instance, H1 which is a higher timeframe for a day trader and scalper could be considered as a lower time frame to a swing and position trader. Does this imply that H1 is a timeframe of confusion? NO. The answer there is that, H1 to a day trader and scalper is a timeframe of analysis while to a swing and position trader, H1 is an entry and exit timeframe. For that reason, when a scalper is buying on H1 analysis, a position trader may be selling the same market. This is because, to a scalper, the price is buying (a trend) while to a position trader, the buy trend is just a pullback; hence, the sell is the main direction of the market in the weekly and monthly.

Therefore, to successfully trade synthetic indices, a person needs to know the kind of trader that he is. Are you a position or swing trader? Then focus on a position and swing traders. Are you a day, intraday trader or scalper? Then focus on the timeframe that suits that personality.

Looking at the price structure of synthetic indices, one may wonder if a trader can scalp, day trade, swing trade and position trade? Well, the answer is yes. However, I believe the most any trader can do with Boom and Crash is to swing trade. For now, I would not suggest that a trader should take on position trading because none of the markets is up to 5 years. However, considering a trader’s timeframe of reference, the market can accommodate some level of swing trading and a great level of day trading and scalping.

Advantages of Understanding Timeframe Combinations for trading Forex

- It enables a trader to know what the price is doing in a specific time frame

- This is to help traders have precise periods of analysis, entries and exits.

- It helps a trader to avoid FOMO (fear of missing out)

- It helps a trader to know his/her limits and become contented

And there are no disadvantages to staying where you know you can trade successfully……

If this publication has been helpful to you and you desire to know more about synthetic indices, kindly visit our YouTube channel at https://www.youtube.com/c/juvirtrades

If you don’t have a synthetic account, click here to create one.

Disclaimer

Deriv offers complex derivatives, such as options and contracts for difference (“CFDs”). These products may not be suitable for all clients, and trading them puts you at risk. Please make sure that you understand the following risks before trading Deriv products: a) you may lose some or all of the money you invest in the trade, b) if your trade involves currency conversion, exchange rates will affect your profit and loss. You should never trade with borrowed money or with money that you cannot afford to lose.