The Internet is full of many click baits articles and other marketing stuff that has nothing to do with successful trading. In reality, this present a good opportunity for forex scammers and marketers to scam newbies to buy their forex courses. In this article, I am going to share the best and easiest forex pairs to trade and strategies to guide you.

Don’t be left out, Open a free trading account now by clicking here

In my many years of trading, I have come to realize that new and struggling forex traders are mostly carried away with what I called Optimism bias when they get in contact with most of these Forex marketers, thus they can easily be scammed. Please, if you want to be a successful trader, kindly go through this article and try to implement all the suggestions there in.

Here are the best and easiest Forex pairs to trade and strategies

Table of Contents

The Best and Easiest Forex Pairs to Trade and Strategies

There are over 50 different forex pairs in the forex market, trading all of them can be very confusing. My advice to all beginners and struggling forex traders is simple, find the best and easiest forex pairs in the market, study them, analyze and trade them on your demo, before opening your real account.

As a beginner, you need to start with just 1 or 2 pairs, starting with one pair will give you the advantage to study and understand everything about the pair, then develop a strategy that will help you trade the pair successfully on your demo before going to your real account.

Having said that, here are my top best and easiest forex pairs to trade:

Part 1: Currency Pairs

I have three currency pairs that I enjoy trading. I trade these currency pairs because they have a lot of money going through them. As a matter of fact, there are the most traded pairs in the world. So, if you understand a bit of price action, you will be able to milk these market and also manage your risk effectively.

Read: The Complete Guide to Price Action Trading Strategies

The best and easiest Forex currency pairs include:

- EURUSD

- GBPUSD

- AUDUSD

Part 2: Index and Synthetic Indices

I enjoy trading Index and Synthetic indices. For synthetic indices, I go after the spikes (I love spikes). If you are a newbie and you want to trade Synthetic indices especially, Boom and Crash, please go only for the spikes first because with spikes you can easily control your loss. Then you can learn how to trade the candles as you progress.

The best and easiest index and synthetic indices include:

The Strategy

To succeed in forex, apart from knowing the best and easiest forex pairs to trade, you also need a realistic approach to trading. By a realistic approach I mean, having a top down strategy that you can use to analyze your trade from the higher timeframe to your trading timeframe. In this part, I will try to guide you with how you can come up with a good strategy that can make you win in the forex market. First, let look at Chart and Chart pattern

How to Understand Chart Pattern

Chart Pattern is like looking at the cloud, when you look up at the cloud, you can find so many shapes and pattern: shapes like faces of people, animals to maps of countries, etc., In that same cloud, when a Meteorologist zoom in, he or she can see other shapes and patterns that can help him or her to predict the Weather.

Just like the Cloud, the Forex chart is like that, you need to zoom in to really understand what is going on in the market. Two good traders can analysis the same chart and come out with different predictions. It doesn’t mean one is wrong and the other is right. It just a matter of how they understand and can interpret the chart.

Let’s get back to the cloud, there are times that Meteorologists predicts a sunny day, but we see rain falling, does it means they were wrong?

Two theories surfaces from my research:

1. There is what we call forces of nature which can change any known pattern in the cloud, thus faulting the prediction of meteorologist.

2. Maybe the Meteorologist, made some miscalculation during the analysis stage, because most of the times, patterns and shapes can be confusing no matter how hard you zoom in to see them.

The same thing is applicable in the forex market. Sometime, you may see a beautiful pattern and predict an uptrend, but before you know, the market go the other way.

This may happen because of:

- Forces of the market (like the market markers, market orders, etc.,)

- Maybe one of the chart pattern confuse you during the analysis stage.

Strategy Formation

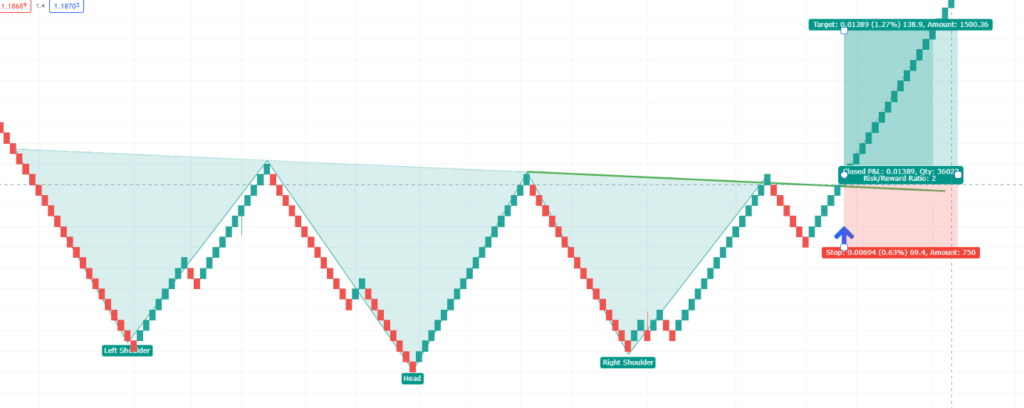

In Science, measurements are always used to decide or determine the outcome of some scientific principles. When you come to Forex, back-testing is a successful tool that guide and help forex traders to hone their skills and strategy to suit their trading goals. For instance, if you are a trader and you wishes to use the head and shoulder pattern to spot entry and exit, it’s will only become a good assistant when used with other price action strategies. That is while, you have to back-test it first with other price action strategies, then move over to your demo to practice it before opening your real account.

Don’t be left out, Open a free trading account now by clicking here

Head and Shoulder Pattern

Head and Shoulder Pattern is one of the most used pattern in trading. Although a study from New York Federal Reserve describes those who speculate using the “head-and-shoulders” chart pattern, as noise traders, I still use it most time. For those who are close to me, especially my mentees, I have consistently informed them that head and shoulder pattern works well on higher timeframe, and to trade these best easiest forex pairs you need more than head and shoulder pattern.

Strategy for trading the best and easiest forex pairs

Understand Market forces

Market forces are the action of forex traders in the market that cause the prices of goods and services to change. For Currency pairs, you can’t control the effect of the big Market Makers, but I want you to do at the opening of every trading day is to mark the supply and demand zone before you start trading.

Supply and Demand Zones are the key Resistance and Support zones on the chart. Once you mark those zone, also mark the low and high of the previous day, then draw your trendline to determine the trend of the market on D1.

Doing what I mentioned above will give you a clear overview of the market, thus enabling you to have some Points of Interest (POI) on your chart. Your POI can be when the price gets to your marked support line or when it gets to your marked resistance line, or when it gets to any side of your trendline. Once it get to those lines, you will watch price reaction at those points, then decide to place your trade.

Trading this way will give you over 90% probability of getting winning trade. You can also add one or two indicators if you wish to guide you in taking your decision, but make sure you back-test them and practice on your demo before going over to your real account.

A very important enemy of new and struggling traders is risk management; No matter how good your strategy is, without a good trading psychology and proper risk management you wont succeed. So know the percentage of your equity you wish to risk before placing any trade.

If you have any questions, kindly comment below

Disclaimer

Deriv offers complex derivatives, such as options and contracts for difference (“CFDs”). These products may not be suitable for all clients, and trading them puts you at risk. Please make sure that you understand the following risks before trading Deriv products: a) you may lose some or all of the money you invest in the trade, b) if your trade involves currency conversion, exchange rates will affect your profit and loss. You should never trade with borrowed money or with money that you cannot afford to lose.