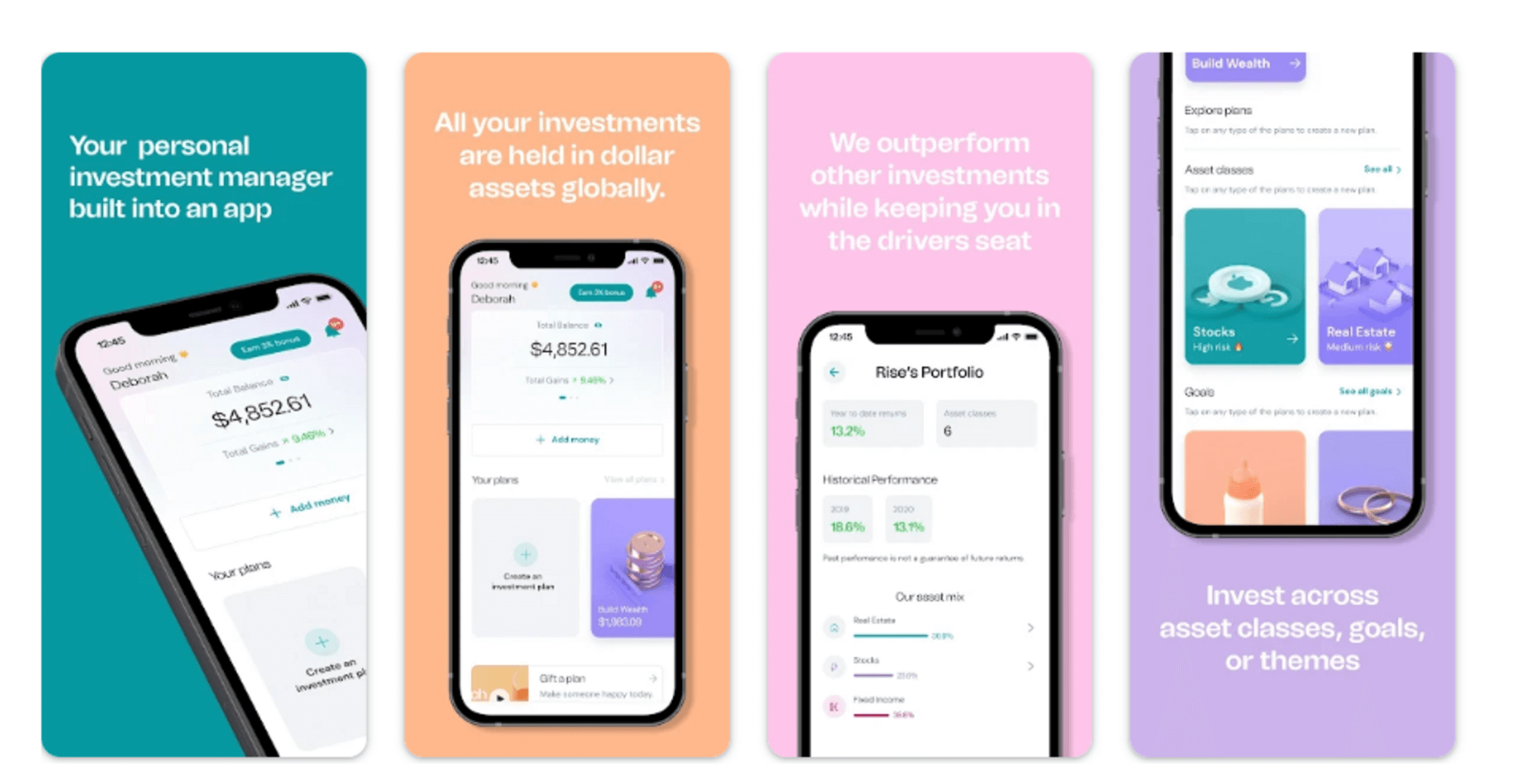

Nigeria’s booming dollar asset manager- is committed to building wealth and empowering its investors towards achieving financial stability.

Founded in 2014 by Crypto Exchange cofounder Eleanya Ekeurum and Bosun Olanrewaju, Risevest which is also popularly known as “Rise” is a digital fintech platform that allows Nigerians to connect with foreign investments.

This article will explain more about Risevest, how to open an account, and how to conveniently access its dollar investment feature.

Table of Contents

How does Risevest works?

Risevest is a digital dollar asset manager that enables users to conveniently invest their money in dollar assets(US stocks, Fixed income, US real estate) that will most likely yield consistent profits over some time.

To achieve the above goal, the app which is a fund manager app, takes control of your intended money-for-dollar investment, and goes further to invest the money in profitable foreign companies including Google, Apple, Tesla and Alibaba on your behalf.

Before a dollar investment is made for you by Risevest, they will provide you with three investment products to choose any that suits your financial ability.

Dollar investment products

Fixed income(low risk, low rewards)

This investment product is offered in the form of Eurobonds and it requires a lesser amount of investment. The fixed income option offers a fixed amount of interest within a stipulated time.

Real Estate Investment

This investment option provides investments in high-demand commercial properties which will yield high returns over some time (3,6,12 months). This option suggests more investment capital compared to the Fixed income option.

Stocks( highest risk, highest reward)

An investment in foreign stocks promises the highest possibility of acquiring twice your investment capital throughout your investment duration but it also had the same possibility of failure.

The app provides users with a variety of investment options to ease the comfort of investment and enhance users’ decisions.

Is Risevest safe to use?

The app is safe. It maintains security and privacy standards relevant to the most famous banks in the world. Its security feature is also regulated by the world’s ARM and the Security and Exchange Commission(SEC).

Transaction charges

- Risevest provides a flexible service structure and charges that users will never find alarming.

- The charges are simply dependent on the percentage of returns, they earns for you. The charges range from 1.5% – 2% of total investment and returns.

- The app is fair, it does not charge a service fee if investment earnings are below 10%. It charges 1.5% for investment returns between 10- 15% and 2% for investment returns 15% and above.

How to open an account on Risevest

- Opening an account on the app is easy. You can download the app from your android’s google play store or your IOS device Apple’s app play store.

- After the app download, open the app and click on “Register” to create an account with Risevest.

- You will be required to provide your Email address and create a password for your account.

How to fund your Wallet

- After you have successfully created your account, you will be redirected to the App’s homepage.

- You can not go further with your intended dollar investment if there is no money deposited in your Risevest wallet.

- To fund your Risevest wallet, click on the “add money ” button on the Risevest app’s homepage, and you will be redirected to the next page.

- On the next page, you will be presented with 5 payment options ( direct debit, bank transfer, naira debit card, crypto wallet and USD credit card), select your preferred payment method and complete your deposit.

How to invest with Risevest

- To invest with Risevest you will have to create an investment plan.

- You can create an investment plan by selecting your investment option from the 3 Risevest dollar investment products that would be presented to you(fixed income, real estate, and company stock).

- After selecting your dollar investment option, you would have to choose your intended investment duration (3,6,12 months). Your choice of Risevest Investment duration is entirely dependent on how long you are comfortable with investing.

How to withdraw funds on Risevest

- To withdraw funds from your Risevest wallet, click on the “Account” button, and select”Bank & cards”.

- Click on the “+” button to add your bank account.

- Add your card details linked to your bank account and click on “save” to save your card details to your Risevest account.

- After you have successfully added your bank account, click on “withdraw” on your account homepage and select the bank account you had earlier input as your recipient.

- Enter the amount of money you want to withdraw to your bank account, and authorise the transaction with your transaction pin.

To learn more about Risevest, click here

Great content.i need money