If you are struggling in the forex market, then try this 50 pips a day price action trading strategy.

Learn the Secret of Forex Trading, Click here to download a free e-book now

This strategy is beginner friendly, however, you will need a lot of practice. It is a basic three step action trading strategy. Forex is not a get-money-quick scheme; it requires a lot of homework. This strategy works with three basic steps.

- Identify the trend and structure

- Prepare and predict

- Take action and enter the trade

The reason majority of traders cannot make 50 pips a day with price action trading strategy is that they don’t conduct any analysis. You need to understand that market analysis is the backbone of any trading activity. Entering trades blindly will have you burning through all your investment. For this strategy, all these three conditions have to manifest before getting into a trade. You can consolidate market news with price action trading to have better chances of finding sure trades.

Table of Contents

How to Make 50 Pips a Day with Price Action Trading Strategy

Trend identification

Since we are looking for a way to make 50 pips a day with price action trading strategy, the most obvious way to identify the trend is through simple price action. You can spot the trend easily without adding any drawings, but of course, we want to be sure of our strategy.

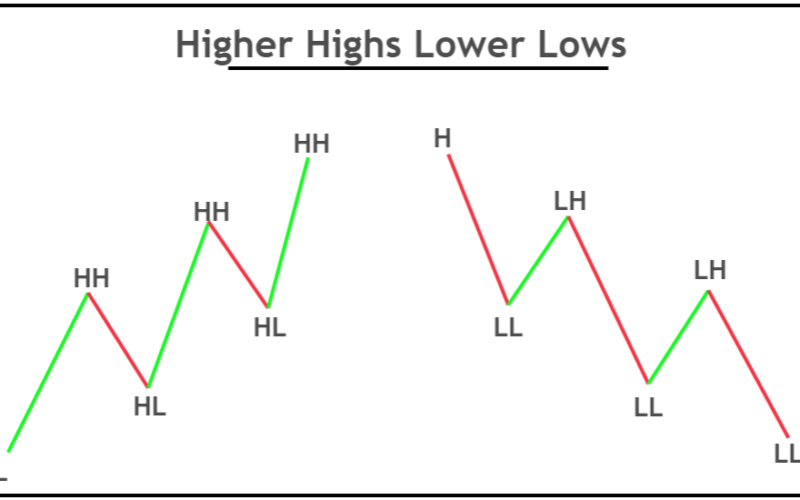

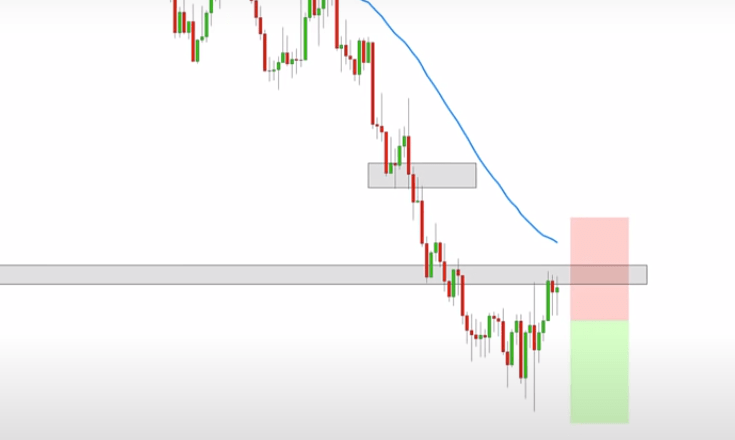

The most direct way of identifying a trend is by checking the market structure. Higher highs and higher lows indicate an uptrend while lower highs and lower lows show a downtrend.

The strategy works best in a market with high volatility.

Simple Moving Average

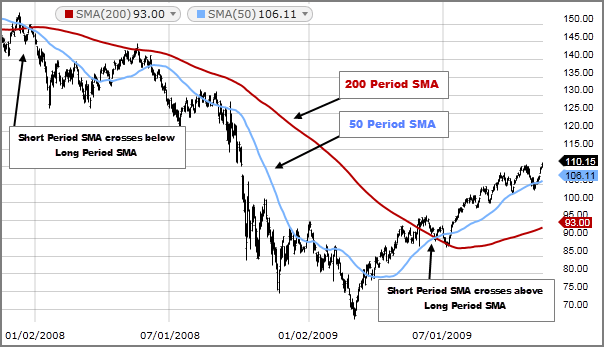

If you want to confirm a trend, you can use a simple moving average. Moving averages are tools for technical analysis which analyze the historical price movement. You can easily read the market direction using the simple moving average/ the 200 SMA is used for long-term trades, and the 50 SMA for intermediate trend and shorter periods can be helpful in shorter-term trends.

Sometimes reading candlestick patterns can be difficult, especially because candlesticks do not read price data smoothly. Longer periods of the SMA usually result in smoother trend readings.

When the price crosses over the SMA, it can be a trigger signs to enter trades. For instance, when the prices are trending above the SMA, then you can consider entering long trades or closing short trades. When the price crosses below the SMA, it can be a reason to enter short trades and close long trades. However, you need a combination of factors to stand out before entering your trades.

You can also take advantage of SMA crossing SMA to enter your trades. When a short period SMA goes above a longer period SMA, that is a sign of trend reversal and you might want to enter a long trade. When a short-term SMA crosses below a long-term SMA, then you might want to enter a short trade.

Read more on using the Simple moving strategy here

Market structure

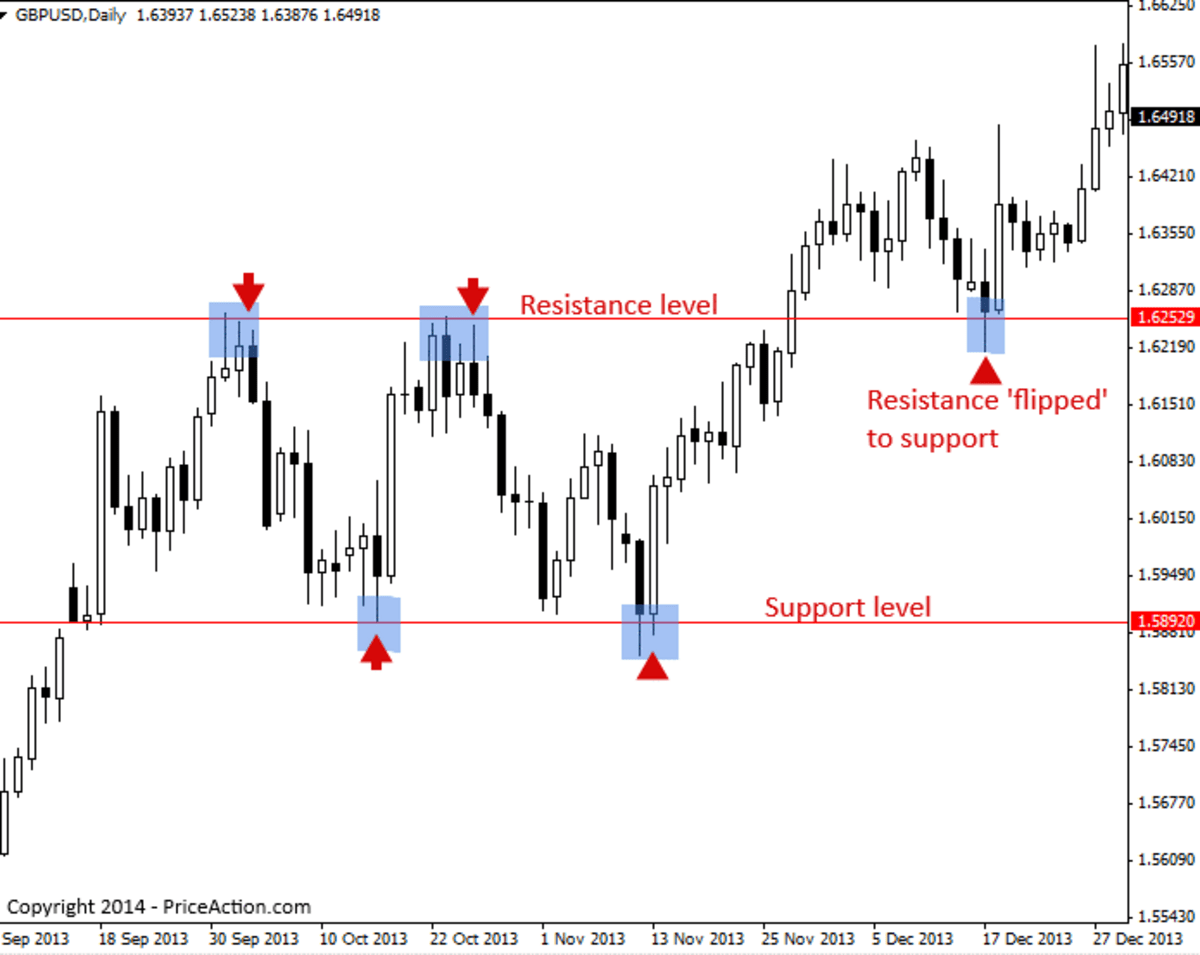

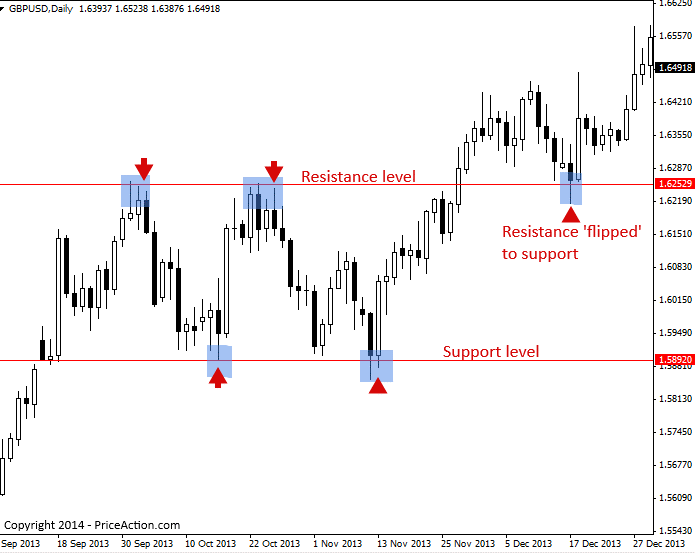

After identifying the trend, it is essential to identify the structure level in the market. Structure levels of interest in this strategy are areas of support and resistance. The structure level that you should take interest in is one that has been tested multiple times, either as an area of support or resistance.

A common challenge that many beginner and intermediate traders face is deciding the range that can form an area of support or resistance. We advise traders to use the rectangle to identify these zones, rather than a horizontal line because it tends to be a range of close prices. The price always respects support and resistance levels until the price breaks past these points. With the price action strategy, we should be on the lookout for signs that the trend will break the support and resistance. You should look out for either buying or selling pressure before entering a trade.

Prepare and predict: How to make 50 pips a day with price action trading strategy

- Identify the market trend using price action and SMA

- Identify areas of support and resistance

- In a trending market, identify the most recent resistance or support level that was tested and confirm that the price has tested it several times

- From the area of resistance or support, the price can either break through or stay within the range. An area of support can become an area of resistance if the price breaks past and vice versa

- Since we are trading with price action, Look out for buying pressure or selling pressure. You can do this by identifying candlestick patterns that would tell you how the market is likely to react to the level of support or resistance

- For instance, an engulfing candlestick and the Doji candlestick show that the market is about to change direction.

Key takeaways

You can easily make 50 pips a day with price action trading strategy once you understand how to identify the trend, know your areas of support and resistance, and how to identify possible entry areas. This strategy also requires keen market analysis.

Disclaimer

Deriv offers complex derivatives, such as options and contracts for difference (“CFDs”). These products may not be suitable for all clients, and trading them puts you at risk. Please make sure that you understand the following risks before trading Deriv products: a) you may lose some or all of the money you invest in the trade, b) if your trade involves currency conversion, exchange rates will affect your profit and loss. You should never trade with borrowed money or with money that you cannot afford to lose.